One of the greatest business visionaries of recent times, former CEO Andy Grove of Intel, believed that “only the paranoid survive” in the context of relentless innovation. Part of Intel’s great success was anticipating and meeting market demand, especially when it came to chip design. The survival sentiment is one that clearly applies to Open Banking – a reality that rewards institutions competing to remain relevant. There are rumblings that

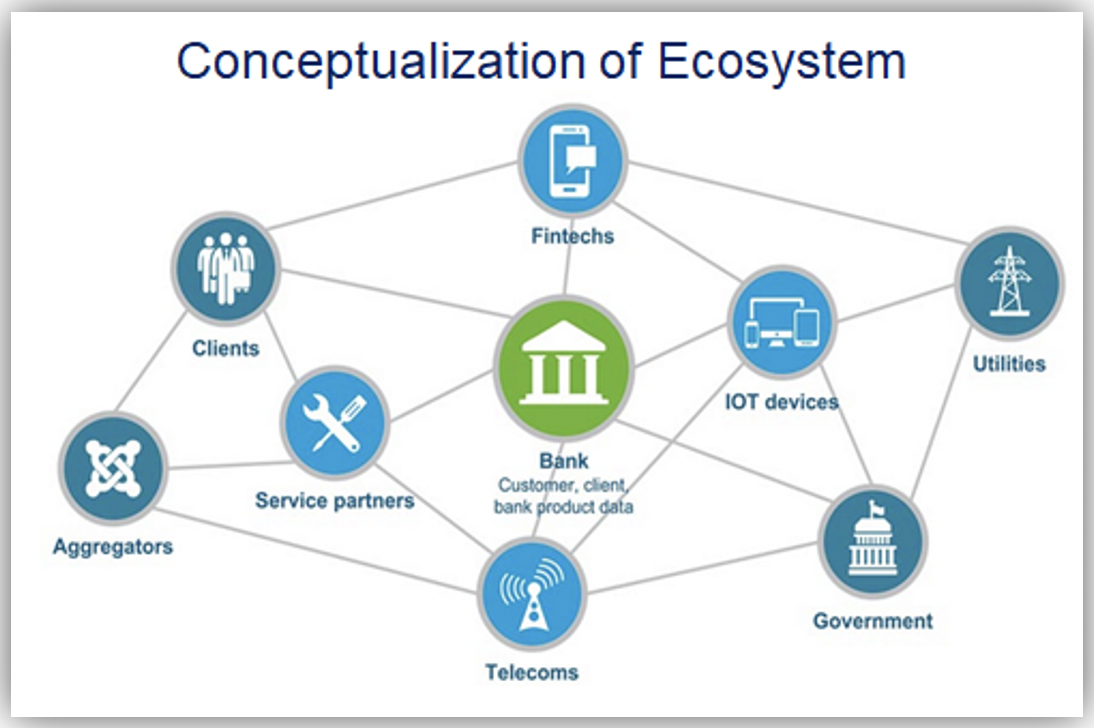

Open Finance and Smart Ecosystems are on their way. But it’s most important to understand how a banking institution needs to orient itself in this new playing field and its potential role in the evolution of the new smart financial ecosystem. In Smart Ecosystems, the holy grail is about finding perpetual inspiration for innovation that drives sustainable customer loyalty.

Open Finance is not waiting on any banks. Banks intentionally define their place in the new playing field within ecosystems. Some institutions are taking core banking activities -- such as account opening, credit decisioning and pricing through APIs -- and making them available to their ecosystem partners. Others are acting as the face for their ecosystem retail partners. The bits of the Open Finance evolution observed so far suggest where banking activities are finding a new life outside the bank, becoming banking services or financial transaction mechanisms that can be called on by ecosystem partners. It’s also clear banks have a lot to offer – beginning with the integrity of handling customer data that comes with a heavily regulated industry. A recent

survey by

Allied Market Research confirms expectations for material growth in the commercialization of banking coming in the form of Open Banking or more broadly Open Finance services, stating,

“Open Banking Market Size to Reach $43.15 Billion, Globally, by 2026 at 24.4% CAGR”.

To lead or not to lead is the question when it comes to Smart Ecosystems. The biggest banks can clearly take the lead and that is exemplified by

Citi and Lloyds Bank. But there’s a lot more to consider and other opportunities for a bank to define its role. Banks could naturally lead the way forward as stewards of an ecosystem’s data platform. It is arguably the best partner equipped to offer valuable insight to its partners – beginning with a customer’s purchasing potential.

In the quest for loyalty, it’s every ecosystem partner’s job to delight customers – sometimes many of them are involved in a single transaction. But to be smart, ecosystems need sensory capabilities through data and analytics that enable them to predict, design and offer services to customers at their critical moments of need. This intelligence is what informs the new financial frontier that lies at the extreme opposite of today’s static banking products. It is a continuum of financial services, micropayments, debt conversions, payment mechanisms, liquidity solutions and yet to be invented forms of “value storage and transfer.” And it is by recognizing this fundamental organizing principle that ecosystem participants continually innovate offerings to meet evolving customer needs. Consistent, flawlessly executed, personalized services that accrete to a customer’s quality of life yield the highest likelihood of achieving customer loyalty.

Through this

series of blogs, we have unveiled the inner workings of an unstoppable and accelerating transformation in financial services. One that leverages customers’ needs as inspiration for personalized service design and delivery. Underpinning it all is a solid data and analytics foundation transforming data into insights effecting smart decisioning. The entry of non-traditional players and inclusion of other industries through Open Finance will deliver more modernized financial services and the timing couldn’t be better.

Finally, institutions should recognize the catalytic role COVID has played in pushing the industry along toward a more permanent commitment to a digital world. There are banks taking action to escape the gravitational pull of traditional banking by spinning off 100%

digital banks, while Big Tech has proven its ability to disintermediate primary banking customer relationships and

profitable niches. Both

avant-garde (e.g., PayPal) and established financial firms (e.g., BNY Mellon) have swung over to accept

crypto currencies, taking a step toward the modernization of cross-border financial transactions. In this dynamic reordering of the financial universe, time is not a bank’s best friend.

“The person who is the star of the previous era is often the last one to adapt to change, the last one to yield to logic of a strategic inflection point and tends to fall harder than most. The strategic inflection point is the time to wake up and listen."

-- Andy Grove

(Author):

Frank Saavedra-Lim

Frank is a financial services professional with extensive global experience as an executive and consultant serving the largest financial institutions in North America, Asia, Eastern Europe, South Africa, and Australia. He specializes in the design, planning, and implementation of risk operating models and supporting infrastructure inclusive of: data analytics and predictive modeling, process redesign, and risk applications development. Frank enjoys a track record as a risk technology innovator credited for conceptualizing and developing patented risk technology solutions for Fortune 100 firms. He has served as an executive panelist at the GARP annual risk management convention, was appointed Risk SME for PRMIA, and is the author of a 2018 Risk Management of the Future Study - a collaboration with the MIT Golub Center For Finance and Policy.

View all posts by Frank Saavedra-Lim