If you have ever shopped online, you will have noticed that a “frequently bought together” section often appears on the checkout page. Or your streaming video provider suggests recommended titles to watch next. How do they know what you need? More importantly, why does it matter?

Consider this,

- As per an Accenture study, 91% of consumers want brands to deliver a timely, personalized experience.

- And 41% of customers say that they will stop visiting a site if it could not “anticipate what they needed, liked or wanted.”

This approach towards customer engagement, called hyper-personalisation or ‘segment of one’, is rapidly becoming a norm in today’s competitive business environment. It is broadly defined as the provision of more relevant products and services in real time to end-users, using data and technology. While traditional personalization is often rule based, hyper-personalization leverages AI or ML technologies to leverage information from big data repositories.

So, how does digital payments data help?

In the world of Big Data & Analytics, granularity is essential. The most incredible value is derived from the ability to expose patterns in data at the lowest level. And in the case of financial services, the lowest level is a customer’s payment transactions.

Such transaction data is key to pre-empt a customer’s needs and tie their values to their spending habits. Imagine how much more effective your marketing campaigns could be if you understood your customers according to their life journey — rather than through limited data captured during few points in time.

Successful hyper-personalization usage requires two critical ingredients:

1. A ccomprehensive data repository that includes payment data;

2. A data analytics capability that consumes all data into one view and gain insights.

Delight your customers with deep insights enriched by payment data

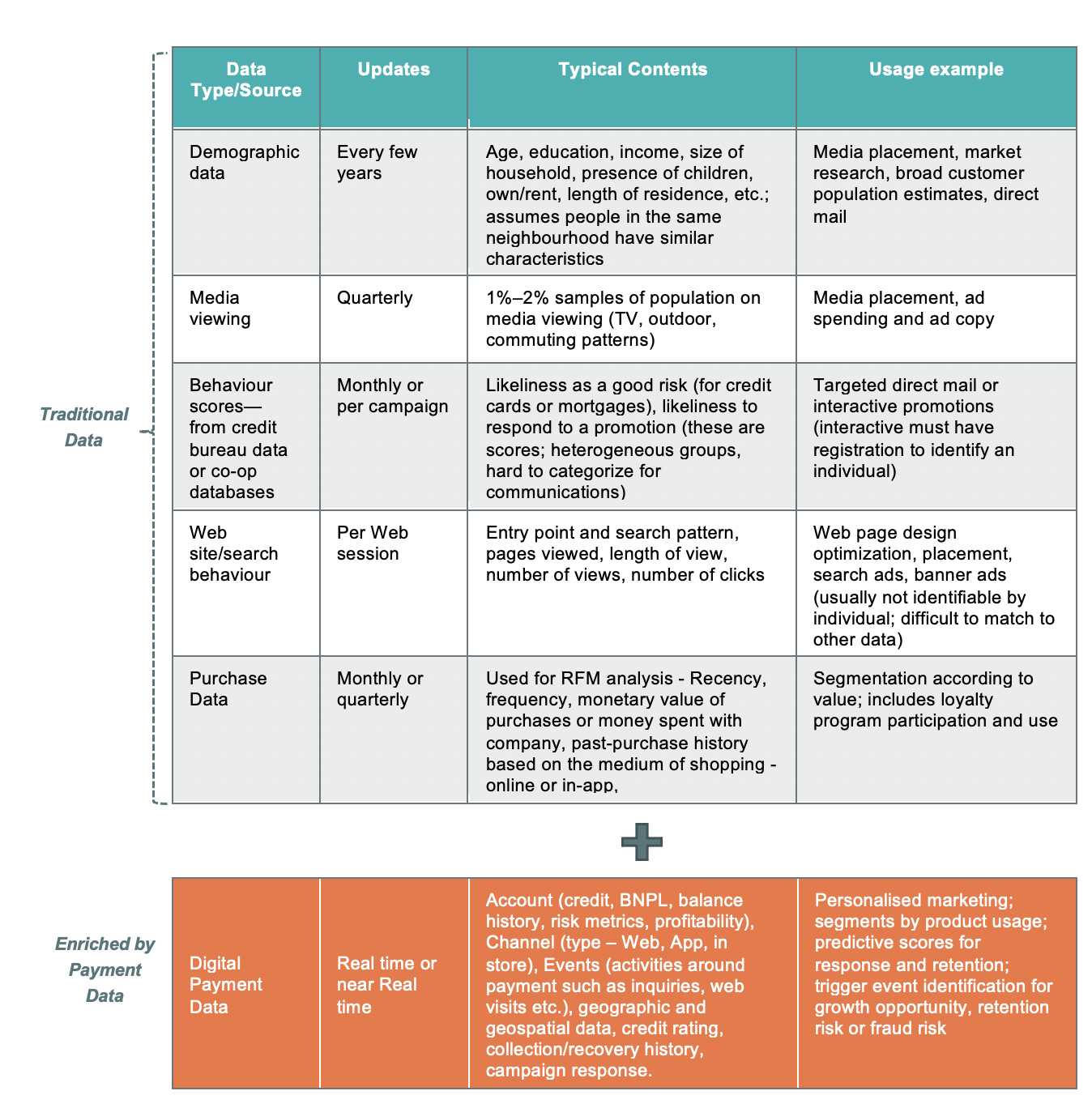

The table below lists typical data sources used for customer personalization. Clearly, if you are not leveraging digital payment data (highlighted in orange), then you are missing out on a rich trove of information that can build a deeper understanding of your customer’s life journey and create contextualized customer experiences.

Large payment companies such as PayPal use hundreds of payment data points to create customer genome sequences that generate strong signals for personalization, targeted advertising, and recommendations.

Or as a retailer you can leverage beacon technology to recognise shoppers and design their in-store personal shopping experience in real time while redeeming reward points at point of sale. In fact, the marketing agency Helloworld found that 55% of millennial respondents like surprises. So, if you are targeting millennials, offering personalized surprises like discounts at checkout is a must.

Leverage enterprise analytics technology to address hyper-personalization challenges

According to The Clear Path to Personalization report by Forbes Insights and Arm Treasure Data, 48% of marketers cite data quality as a leading roadblock to effective personalization.

The biggest challenges marketers face regarding personalization are gaining insights quickly enough, having enough data and having accurate data. The growth of AI, machine learning, and deep learning technology addresses these challenges head-on. This allows marketers to take personalization to a whole new level — using data as the voice of the customer — so they can match and tailor digital experiences to customer journeys.

For example, Teradata’s Vantage CX enables real-time dynamic personalization at scale by determining the optimal message to deliver based on both what the customer is doing right now combined with historical, integrated information on that customer’s experiences and behaviours.

...And adapt fast to rapidly developing data regulations

Furthermore, collection, storage and usage of personal data has come under increased scrutiny, which can significantly impact personalization strategies. GDPR enforces European customers' "right to be forgotten" (making it unlawful to store data collected from an individual without consent). The APJ region remains diverse in its approach to regulation with each jurisdiction taking its own tactic in regulating data. Companies will have to adapt a direct, transparent approach towards customer data. Collecting only zero-party data (data a customer shares voluntarily in return for personalized offers and recommendations) not only provides confidence to end consumers, but also builds an engaging relationship. This also becomes a critical factor in choosing your data and analytics partner – someone with extensive regional data governance and operational experience.

(Author):

Shreyansh Durgesh

Shreyansh Durgesh is an experienced payment professional and has worked for over 18 years in the technology consulting and financial services industry across geographies - U.S., UK and Asia. In his past roles at PayPal, Visa and American Express, he led key business initiatives and strategic alliances in Asia with merchants, payment processors and other ecosystem stakeholders. He holds an MBA degree from National University of Singapore.

View all posts by Shreyansh Durgesh