Every abandoned shopping cart is lost revenue for a business, but it is more than just financial metrics. Payment friction leads to negative brand impressions. And for a large business, operating at a scale of hundreds of shoppers per minute, even a small increment in checkout conversion can lead to significant improvement in customer experience.

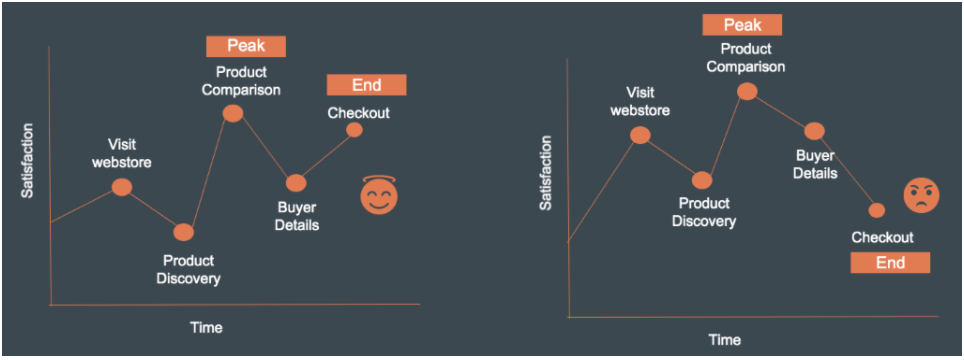

Why is it so? Contrary to common belief, a shopping experience is not based on the total sum or average of every moment of the journey. We judge it largely based on how we feel at its peak (i.e., its highest point - good or bad) and at its end. UX researchers have been using this behavioral psychology for product design, also known as the “peak–end rule” -- a cognitive bias that impacts how people remember past events. When applied to business context - designing shopping interfaces and experiences, pay attention to the most intense points of a typical user journey (the “peaks”) and the final moments (the “end”) which is usually the payment checkout.

Let us see how this works in a typical online shopper’s journey. Say two customers are buying from an online shop as shown in the figure below. In the first example on the left, the buyer experience has a positive “peak” and “end.” In the second case, the buyer has a slightly higher positive experience at earlier stages of journey, however, is frustrated with payment failures and retires. When compared, the first experience will be rated much more positively than the second one, even though the latter has higher-than-average positive moments – except for the checkout.

As a culmination of a business’ product, sales and marketing efforts, checkout has anoutsized impact on revenue, profitability and brand perception.

The question becomes: How do we improve payment conversion to improve the overall customer shopping experience? Several payment conversion issues and associated best practices to mitigate are:

1) Poor UX design such as non-responsive design, lack of localization, unclear call to actions or navigation flows, long and complicated checkout processes, forced registration, over-zealous fraud detection or technical errors result in cart abandonment. Reduce these frictions by conducting customer discovery exercises and optimizing experience based on customer needs, checkout behavior, devices used and location

2) Lack of preferred payment options is one of major cause of cart abandonment. Payment options vary by region, country and even at a personal level. Hyper-personalization and web technologies allow businesses to deeply understand customer needs and offer personalized payment options by rendering dynamic pages.

3) Too many or too long redirects to third party payment pages or during 3D secure authentication can lead to dropouts. Typical fixes include using API-based integrations to build consistent experiences and risk-based authentication (like 3DS 2.0). Furthermore, some businesses are using backend smart routing technologies to recover failed transaction without creating customer experience friction

These “conversion killers” can become an even a bigger challenge for large businesses that handle thousands of customers per hour. Thankfully, with the latest data technologies and machine learning tools, we can address these common conversion issues in a more effective manner. This can lead to design of best-in-class customer experience by focusing on three things: understanding customer needs, implementing the right set of tools for checkout strategy and constantly monitoring conversions to adjust as needed. For example, some recommended data technologies are:

1) Path analysis can help you examine the users flow, the pages they visited or the screens they visualized, and their interactions with elements like buttons or forms. It returns deeper and more useful insights on possible bottlenecks that prevent the onboarding of users or the completion of a purchase, thus optimizing the whole navigation flow.

2) Funnel analysis helps you investigate the set of consecutive steps users take in order to reach a goal, such as the checkout process in case of a purchase. The funnel analysis is thus aimed at measuring and improving that well-defined flow to support users going through the path and reaching the conversion.

3) Conversion rate optimization analysis conducts extensive data analysis that considers multiple issues and appropriate optimizations to improve payment completion. This provides recommendations to be implemented such as redundancy in checkout process, effectiveness of call to actions, the navigation flow and if necessary, puts assumptions into testing such as A/B testing.

4) Predictive analysis forecasts what might happen in the future - with a higher level of reliability - extracting information from historical and current data sets, searching for patterns and correlations, trends in customers’ website browsing history or buying behaviors

These recommendations are not comprehensive. Each business has its own unique needs that require discovery discussions to understand key pain areas so they can deploy appropriate data technologies to address conversion challenges. While a 100% conversion rate in unrealistic, moving closer to 100% even in small increments will add tremendous overall value to any business. The effort to continuously improve the payment conversion rate is more than financial metrics - it should be a cornerstone of the overall customer experience strategy. Last impressions are lasting impressions, and a successful business cannot ignore the need for building a great checkout experience today.

(Author):

Shreyansh Durgesh

Shreyansh Durgesh is an experienced payment professional and has worked for over 18 years in the technology consulting and financial services industry across geographies - U.S., UK and Asia. In his past roles at PayPal, Visa and American Express, he led key business initiatives and strategic alliances in Asia with merchants, payment processors and other ecosystem stakeholders. He holds an MBA degree from National University of Singapore.

View all posts by Shreyansh Durgesh